Cyan Investment Management offers a single investment product, the Cyan C3G Fund.

The objective of the Cyan C3G Fund is to consistently deliver meaningful positive returns for investors by investing in a portfolio of 20 to 40 promising or proven ASX listed companies, weighted appropriately to balance risk and return.

Because we believe outstanding returns in the domestic market can only be achieved with a discreet amount of capital, the C3G Fund will be strictly closed to new investors once the Fund size reaches $100m.

The principal objectives of the Fund are:

- To achieve meaningful positive returns over the long-term;

- To achieve these returns by making only conservative and considered investments in the most attractive opportunities in the ASX small-cap sector.

Our Core Philosophies

- Smaller companies that are well positioned, managed and resourced have potential for growth that far exceeds larger companies;

- Individual small-cap stocks are not necessarily risky, although certain sectors within the smaller companies space certainly are, hence we do not invest in biotechnology or resources companies;

- When appropriate, we concentrate on the IPO market as we consider newly listed companies experience a significant degree of information and price inefficiency;

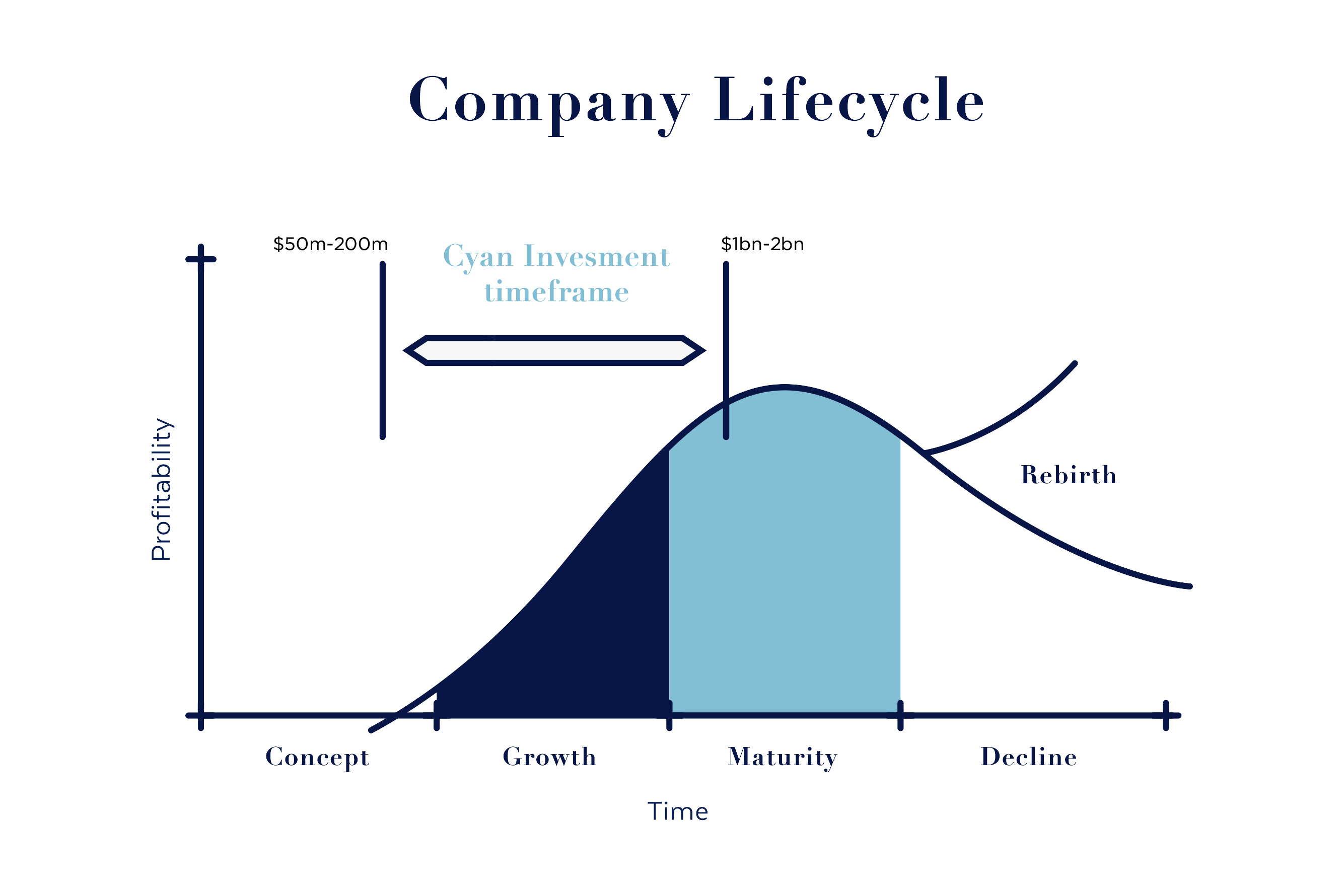

- We also concentrate on companies that have a market capitalisation between $50m and $200m as, typically, these companies are commercially proven but have not, as yet, been discovered by the broader investment community;

- We aim to invest for the long-term. Companies mostly don’t change in inherent value significantly over short periods of time;

- We do not tolerate poor performers and sell when companies in which we have invested disappoint;

- We consider broker research is typically conflicted and hence we conduct our own detailed research on potential investments;

- We have a conservative philosophy and we only invest when we consider the risk/return equation to make sense. As such the C3G Fund may, at times, hold a significant balance in cash.